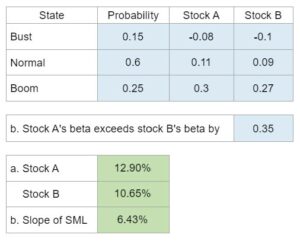

Problem 11.29 – Calculating Expected Returns and Market Risk Premium

Calculate the expected return on two stocks based on the probability of states of the economy and compare them based on the Capital Asset Pricing Model. Then, determine the expected market risk premium.

Experts Have Solved This Problem

Please login or register to access this content.