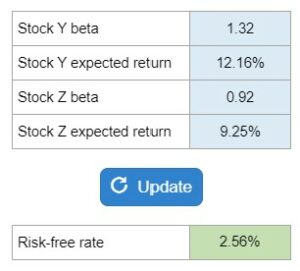

Problem 11.19 – Stock Y and Stock Z Equilibrium Risk-Free Rate for Stock Pricing

Determine the risk-free rate required for two stocks to be correctly priced, given their betas and expected returns.

Experts Have Solved This Problem

Please login or register to access this content.