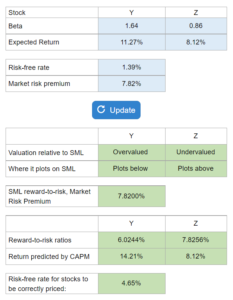

Problem 11.19 and 11.20 – Stock Y and Stock Z

Determine whether the two stocks are undervalued or overvalued, and the risk-free rate that would result in the two stocks being correctly priced relative to eachother.

Experts Have Solved This Problem

Please login or register to access this content.