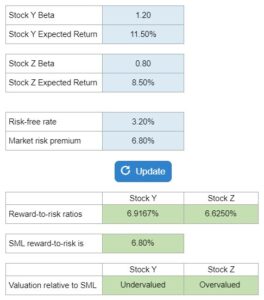

Problem 11.18 – Stock Y and Stock Z Stock Reward-to-Risk Calculation

Calculate the reward-to-risk ratios for stocks given their betas, expected returns, risk-free rate, and market risk premium. Classify the stocks based on their reward-to-risk ratio in comparison to the SML reward-to-risk ratio.

Experts Have Solved This Problem

Please login or register to access this content.