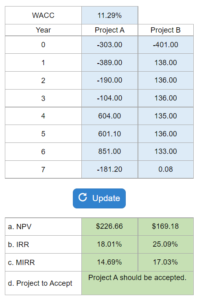

Problem 11.17 – Project A & Project B

Given two cashflow timelines, you are asked to determine each project's NPV, IRR, and MIRR. You are also asked to construct an NPV profile graph and calculate the crossover rate where the two projects' NPVs are equal.

Experts Have Solved This Problem

Please login or register to access this content.