Problem 11.15 – An Oil-Drilling Company

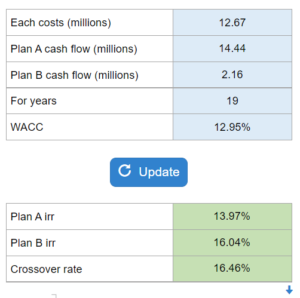

Given each plans cost, cash flows, and WACC... construct NPV profiles for both plans identify each project’s IRR, and show the approximate crossover rate.

Experts Have Solved This Problem

Please login or register to access this content.