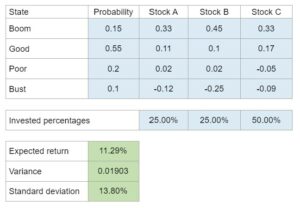

Problem 11.10 – Stock A, B, & C Expected Returns and Standard Deviations For A Portfolio, 3 Stocks, 4 Scenarios

Calculate the expected return, variance, and standard deviation of a portfolio with investments in 3 stocks given their respective rates of return and probabilities of occurrence for 4 different economic states.

Experts Have Solved This Problem

Please login or register to access this content.