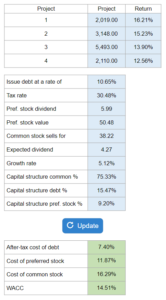

Problem 10.18 – Adamson Corporation

Given the cost and expected rate of return for each project, issue debt, tax rate, preferred stock dividend and value, current common stock selling price, next expected dividend, growth rate, and target capital structure... determine the cost of each capital component, WACC, and which projects should be accepted.

Experts Have Solved This Problem

Please login or register to access this content.