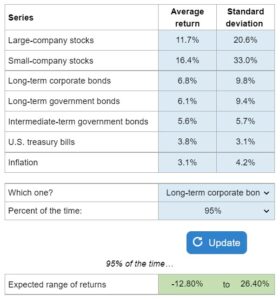

Problem 10.17 and 10.18 – Expected Range of Returns for Different Asset Classes

Calculate the expected range of returns for a specific asset class based on the average return and standard deviation data provided in a table, for a given percentage of the time. Find the 68%, 95%, and/or 99% ranges of the returns.

Experts Have Solved This Problem

Please login or register to access this content.