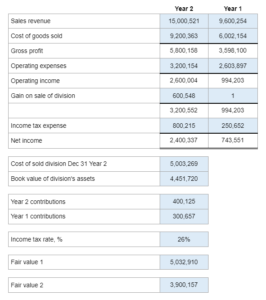

P4.02 – Jackson Holding Company

Given condensed income statements for two different years along with book values and contributions in those years... prepare three revised income statements.

Experts Have Solved This Problem

Please login or register to access this content.