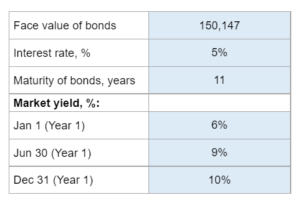

Given the face value of bonds, the interest rate, the years till maturity, and the market yield percent in three different years... determine the fair value along with preparing numerous journal entries related to the bond investment.

Experts Have Solved This Problem

Please login or register to access this content.