Problem 11.19 – Project Analysis

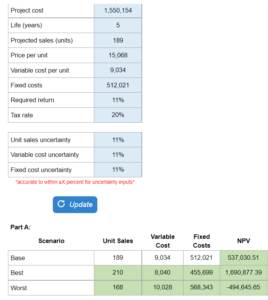

Find upper and lower bounds for projections, base-case NPV, best-case and worst-case scenarios, the sensitivity of base-case NPV to changes in fixed costs, the cash break-even level, the accounting break-even level, and the degree of operating leverage.

Experts Have Solved This Problem

Please login or register to access this content.