P 16.05 – The Vineyard, Installment Sale of Property

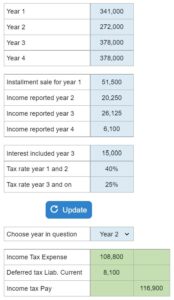

They give you the income statement for 4 years along with the reported income collected each year and the tax rate. Asks for the journal entries for each year including the tax expense, deferred tax liability, and the income taxes payable.

Experts Have Solved This Problem

Please login or register to access this content.