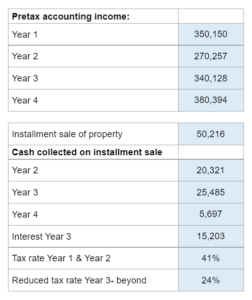

Given the year one pretax accounting incomes for the four-year period, the investment on the sale of the property, and the interest on the sale of the property along with the tax rate... prepare the year-end journal entries to record income taxes for the four years.

Experts Have Solved This Problem

Please login or register to access this content.