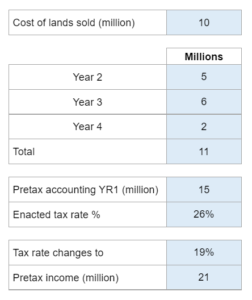

Given the cost of sold land, the amounts collected per year, the pretax income in year one, and the enacted tax rate... prepare journal entries for the income tax along with the deferred tax liability.

Experts Have Solved This Problem

Please login or register to access this content.