P 16.02 – Times-Roman Publishing Company

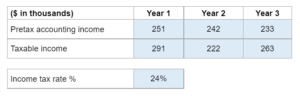

Given the pretax accounting income, the taxable income, and the income tax rate ... find the cumulative temporary difference along with the deferred tax asset for three years.

Experts Have Solved This Problem

Please login or register to access this content.