P 14.03 – Bradley Recreational Products

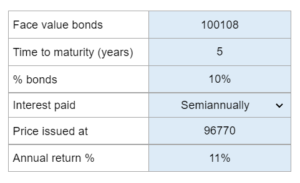

Given the face value of a bond, the time to maturity, the percent of the bond, when interest is paid, the price issued at, and the annual return ... prepare an amortization schedule using both effective and straight-line methods while also preparing a journal entry to record the interest.

Experts Have Solved This Problem

Please login or register to access this content.