P 11.01 – Generally Accepted Accounting Principles

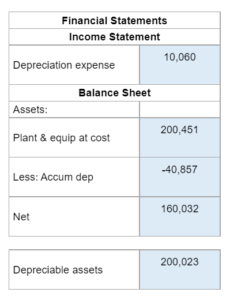

Given the information from the year-end balance sheet and income statement and ask you to determine the depreciation expense using double declining balance along with preparing a journal entry for depreciation.

Experts Have Solved This Problem

Please login or register to access this content.