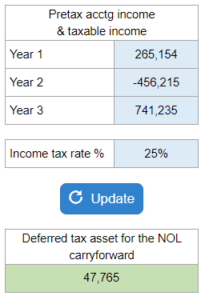

MC 16.91 – Puritan Corp. Deferred Tax Asset

Given pretax income and tax rate they ask you to determine the amount reported as the deferred tax asset for the NOL carryforward.

Experts Have Solved This Problem

Please login or register to access this content.