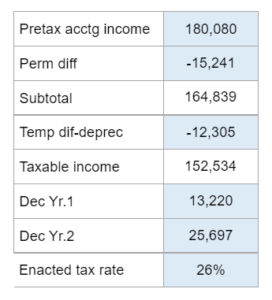

Given the pretax accounting income, permanent differences, temporary differences-depreciation, taxable income, and the enacted tax rate... figure out the deferred tax liability.

Experts Have Solved This Problem

Please login or register to access this content.