MC 16.108 – MC 16.111 Hobson Corp. – Tax Expenses and Income Reporting

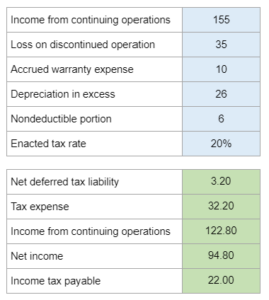

Determine the tax expense on income from continuing operations, income from continuing operations, net income, and income tax payable for the current year for Hobson Corp, based on the provided financial information.

Experts Have Solved This Problem

Please login or register to access this content.