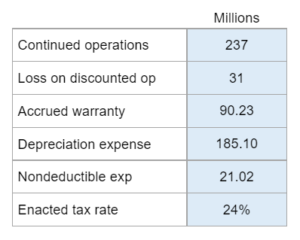

Given the income from continuing operations before tax, loss on discontinued operations (pretax), temporary differences, permanent differences, tax rate... figure out the expenses on income from continued operations.

Experts Have Solved This Problem

Please login or register to access this content.