Exercise 9.09 – Paradise Partners: Comparing Installment Notes and Leases for Equipment Upgrade

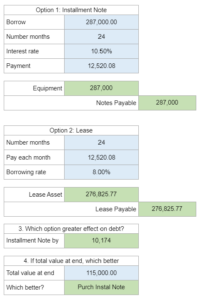

Compare installment notes and loans. Determine whether Paradise Partners should purchase the equipment with an installment note or lease it, based on the financial implications and the equipment's value at the end of the 24-month period. Compare the effects on the company's reported debt and make a decision.

Experts Have Solved This Problem

Please login or register to access this content.