Exam – Estimating Daves Inc.’s WACC

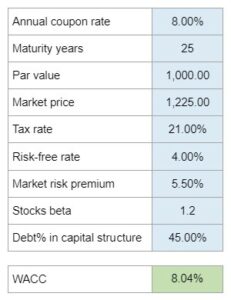

Calculate Daves Inc.'s Weighted Average Cost of Capital (WACC) using the given information on noncallable bonds, tax rate, risk-free rate, market risk premium, stock beta, and target capital structure. Do not round your intermediate calculations.

Experts Have Solved This Problem

Please login or register to access this content.