Exam – Determining the NPV of a Project with Depreciation and Salvage Value

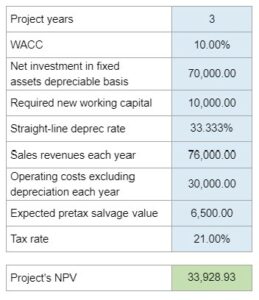

Calculate the net present value (NPV) of a project that involves purchasing new equipment with a 3-year tax life. The equipment will be fully depreciated over 3 years using the straight-line method and will have a positive pre-tax salvage value at the end of Year 3. Additionally, new working capital is required but will be recovered at the end of the project's life. The project's revenues and operating costs are expected to remain constant over the 3-year period. Determine the project's NPV.

Experts Have Solved This Problem

Please login or register to access this content.