Exam – Comparing Mutually Exclusive Projects for Equivalent Annual Annuity

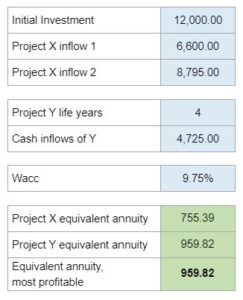

Determine the equivalent annual annuity of the most profitable project among two mutually exclusive projects with different expected lives and cash inflows, given the initial investment and the firm's weighted average cost of capital.

Experts Have Solved This Problem

Please login or register to access this content.