Exam – Calculating Quigley Company’s Weighted Average Cost of Capital (WACC)

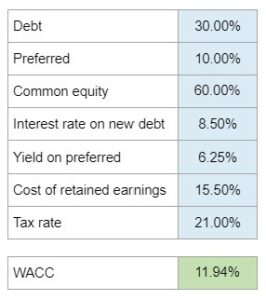

Determine Quigley Company's WACC by considering the target capital structure and the respective costs of debt, preferred equity, and common equity.

Experts Have Solved This Problem

Please login or register to access this content.