Exercise 05.19 & 05.20 – Suzuki Supply

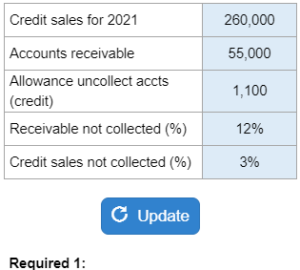

Given the credit sales for the year, accounts receivable, allowance of uncollectible accounts, percent of receivables not collected, and the percent of credit sales not collected... record the adjustment using the receivables and credit sales method as well as calculate effect on net income and assets.

Experts Have Solved This Problem

Please login or register to access this content.