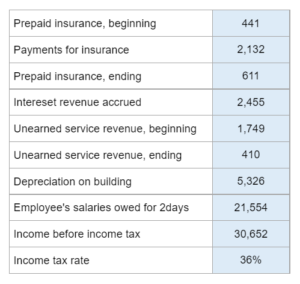

E3-30B – Overstatement? Understatement?

Given the adjustments, prepare the adjusting entries along with the overstatement or understatement if the adjustments weren't made.

Experts Have Solved This Problem

Please login or register to access this content.