Exercise 03.08 & 03.09 – Huskies Insurance Company

NOTE: This solver answers TWO separate Huskies problems! The second calculator is below the first one!

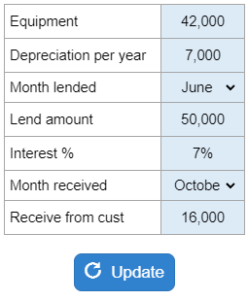

Involves two questions. First question gives a list of transactions where you need to record adjusting entries at year-end. Second question gives you a list of transactions where you need to calculate the effect on net income.

Experts Have Solved This Problem

Please login or register to access this content.