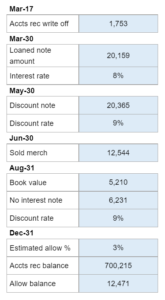

E 7.28 – Weldon Corporation’s Receivables Transactions and Year-End Adjusting Entries

Prepare journal entries for all receivables transactions that occurred, including the allowance method for uncollectible accounts, loan transactions, discounting notes, sales of merchandise, and adjusting entries. Round all calculations to the nearest dollar.... prepare journal entries for each transaction.

Experts Have Solved This Problem

Please login or register to access this content.