E 4.08 – Kandon Enterprises, Inc.

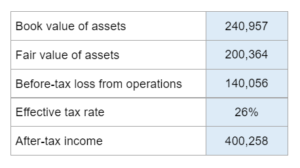

They give you book value, fair value, before tax loss, tax rate, and after-tax income, they want you to make a partial income statement under two scenarios.

Experts Have Solved This Problem

Please login or register to access this content.