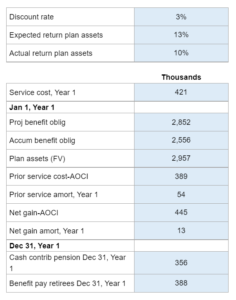

E 17.11 – Barry Financial Services Inc.

Given information regarding their pension plan... calculate the pension expense along with preparing a journal entry to record the expense, gain or loss, funding, and the retiree benefits.

Experts Have Solved This Problem

Please login or register to access this content.