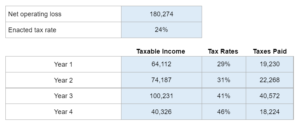

Given the net operating loss, the tax rate, and a list of taxes for four years... find the operating loss carryback and carry forward along with preparing a journal entry for the taxes and calculating net loss.

Experts Have Solved This Problem

Please login or register to access this content.