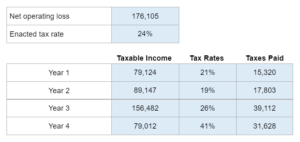

Given the net operating loss, the tax rate, and a list of taxable incomes for four consecutive years... prepare a journal entry for the taxes along with calculating the income tax benefits, the operating loss, and the net loss.

Experts Have Solved This Problem

Please login or register to access this content.