E 16.23 – Baginski Steel Corporation

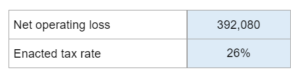

Given the net operating loss and the enacted tax rate ... prepare a journal entry for the taxes along with calculating operating loss and income tax benefit.

Experts Have Solved This Problem

Please login or register to access this content.