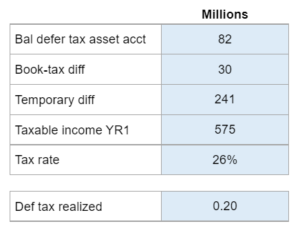

Given the balance of a deferred tax account, the book-tax difference, the temporary difference, the taxable income, and the tax rate... prepare two different journal entries for the tax expenses.

Experts Have Solved This Problem

Please login or register to access this content.