E 13.08 – Interstate Farm Equipment Company

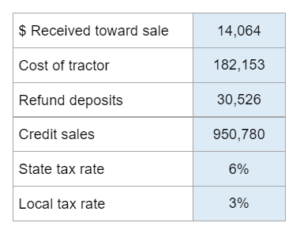

What are the appropriate journal entries for a farm equipment company's liabilities involving: 1) a prepayment for a tractor to be delivered later, 2) refundable deposits for equipment part transportation containers, and 3) credit sales subject to state and local sales taxes? Given the information regarding their liabilities for the year... prepare several journal entries for the transactions.

Experts Have Solved This Problem

Please login or register to access this content.