E 11.30 – General Optic Corporation

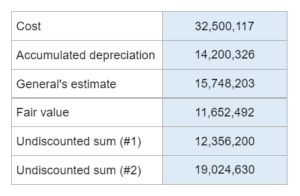

Given the cost, accumulated depreciation, the general's estimate, and the fair value... determine the amount of impairment loss along with preparing a journal entry for the loss.

Experts Have Solved This Problem

Please login or register to access this content.