E 11.07 – Susquehanna Insurance

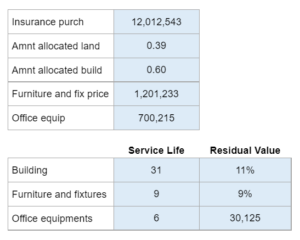

Given the amount and allocation of a building purchase, the furniture and fixtures price, the office equipment price, and a list of service life and residual values... calculate the depreciation for two years.

Experts Have Solved This Problem

Please login or register to access this content.