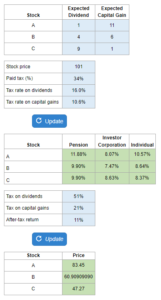

Problem 17.24 – Pretax Return

Determine the following for Little Oil: what rpice will the new shares be issued in year 1, how many shares with the firm need to issue, expected dividend payments on these new shares after year 1, and the present value of cash flows to current shareholders.

Experts Have Solved This Problem

Please login or register to access this content.