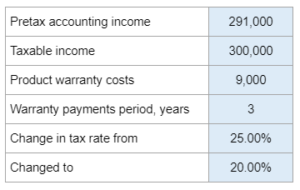

Given pretax accounting income, taxable income, warranty costs, and two tax rates they ask you to determine the current tax payable balance along with recording a journal entry for income taxes.

Experts Have Solved This Problem

Please login or register to access this content.