BE 16.09 – Differences between pretax income, deferred tax asset

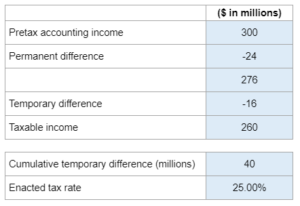

Given the differences between pretax income and taxable income along with the tax rate they ask you to calculate the deferred tax liability.

Experts Have Solved This Problem

Please login or register to access this content.