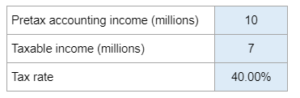

BE 16.04 – A company reports pretax accounting income…

Given pretax accounting income, taxable income, and the tax rate they ask you to prepare a journal entry to record income taxes.

Experts Have Solved This Problem

Please login or register to access this content.