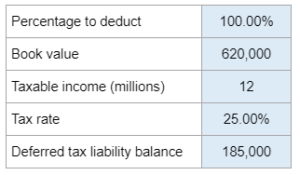

BE 16.03 – Milo Manufacturing

Given book value, taxable income, tax rate, and deferred tax liability they ask you to determine the deferred tax liability of the new year along with preparing a journal entry to record income taxes.

Experts Have Solved This Problem

Please login or register to access this content.