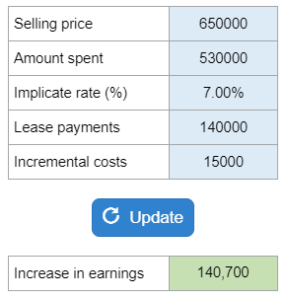

BE 15.16 – Bryant, leased equipment

Gives you the selling price, the amount spent, the implicit rate percentage, the lease payments, and the incremental cost. Asks for the amount to be added to the sales-type lease.

Experts Have Solved This Problem

Please login or register to access this content.