BE 15.06 – A lease agreement qualifies, increase in earnings

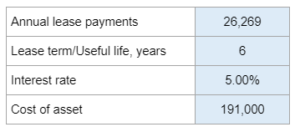

Given the annual lease payment, years on the lease, interest rate, and cost of the asset they ask you to determine the present value of the lease, prepare an amortization schedule, and show the total expenses on the lease.

Experts Have Solved This Problem

Please login or register to access this content.