BE 10.05 – Smithson Mining, liability and retirement

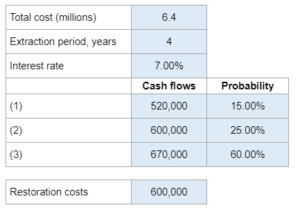

Given total cost, extraction period, interest rate, and possible cash flows they ask you to determine the liability increase and gain or loss on retirement.

Experts Have Solved This Problem

Please login or register to access this content.