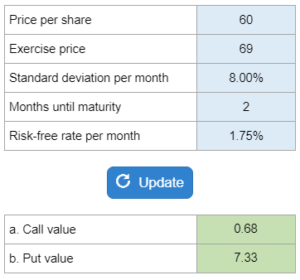

Problem 21-12, Black-Scholes Option Valuation

Determine the call value and the put value using the Black-Scholes formula given a monthly standard deviation and monthly risk-free rate.

Experts Have Solved This Problem

Please login or register to access this content.