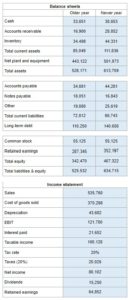

Problem 3.26, 3.27, 3.28, 3.29, 3.30 – Smolira Golf Corp.

Determine the financial ratios, construct a DuPont identity, prepare a statement of cash flows, calculate the price-earnings ratio, dividends per share, market-to-book ratio, PEG ratio, and Tobin's Q for Smolira Golf.

NOTE: This solver solves ALL problems 3.26 to 3.30, A-Z.

Experts Have Solved This Problem

Please login or register to access this content.